Think Like a Trader and Act Like a Trader

May 6, 2023 at 4:32 am 1 comment

Trading in the financial markets requires a unique mindset and approach that sets it apart from other professions. While professionals from various fields, such as engineering, law, or medicine, possess valuable skills and knowledge, it is essential to recognize the distinctions and act as a trader when engaging in trading activities.

Firstly, trading involves embracing uncertainty and risk, which differs significantly from the typical mindset of an engineer, lawyer, or doctor. Engineers are trained to seek stability and minimize risk, ensuring structures and systems function reliably. Lawyers analyze and mitigate legal risks for their clients, while doctors aim to minimize health risks for their patients. In contrast, traders willingly take calculated risks in pursuit of financial gains. They understand that uncertainty is inherent in the markets and develop strategies to manage and profit from it.

Traders make decisions from price charts, indicators, economic factors, and news events that impact prices. Acting as a trader means dedicating time and effort to acting with a system in the financial markets.

Another crucial aspect of acting like a trader is embracing a different decision-making process. For example, engineers, lawyers, and doctors often rely on logical reasoning, precise calculations, and thorough analysis to make decisions in their respective fields. However, trading requires a skill set and knowledge basis; you best learn from those who possess it to make quick decisions based on limited information, manage risk, and adapt to rapidly changing market conditions.

Furthermore, traders must possess discipline and emotional control. While professionals in other fields also require discipline, traders face unique challenges when it comes to managing emotions. The financial markets can be highly volatile and unpredictable, triggering feelings of fear, greed, and impatience. Acting as a trader involves developing emotional resilience, sticking to trading plans, and avoiding impulsive decisions driven by emotions. Lastly, traders must comprehensively understand financial markets to decide on appropriate trading strategies, and we add an example.

Market Analysis with NLT Top-Line Indicators

Market analysis NeverLossTrading style: We take a weekly chart for the SPX or SPY and check for longer-term directional price move expectations. Buying or selling opportunities can be found on the chart by buy > and sell < indications that spell out a price threshold. If the price movement of the next candle reaches the price threshold, a directional trade potential gets validated:

- The first signal to the left: Sell < $405.25, was validated and led to a short trading potential

- On the way down, a second signal confirmed the direction: Sell < $382.11 and led to a trade to target-2

- Buy > $366.37 led to a trade to the dashed blue line

- Since 1/16/2023, SPY remains in an NLT Purple Zone as a sign of directional ambiguity and recommends not to engage in longer-term trades; hence, we neglected Sell < $384.32 (if traded, it would have been a loss).

We love to engage longer-term, but why force hazardous trades when the market does not allow it?

Traders must be proficient in reading the markets, executing trades, managing positions, and using risk management tools effectively. Acting as a trader means acquiring the necessary skills and staying updated with trading technology and strategies advancements.

Traders embrace uncertainty, take calculated risks, prioritize market analysis, utilize a distinct decision-making process and exercise emotional control. As a result, they acquire the expertise to appraise the financial markets at any stage, accepting they never act with 100% certainty but operate with high probability systems and strategies with > 65% likelihood to forecast price actions.

In conclusion, trading is not only about numbers and charts but also about understanding the intricacies of the markets in which one wishes to participate. By adapting one’s trading practices to align with the market, traders can position themselves for success. You want to make informed decisions based on logical analysis rather than being influenced by market tips, emotions or impulsive behavior.

When the longer-term price development is ambiguous, what are the alternatives when you want to trade and engage your money?

- Shorter-term transactions like day trades or swing trades

- Operating with uncorrelated instruments

Let us start with uncorrelated instruments.

Generally, 85% of the stocks and many commodities follow the overall stock market development. If you want to engage longer-term, have a method to decide if an asset is correlated, opposite, or independent of the overall market development.

In NLT Top-Line, we offer a correlation study, helping you to choose assets with overall market-independent development.

With NLT Top-Line, you can scan the market for individual solid price moves with uncorrelated happenings. Another alternative: subscribe to our convenient NLT Alerts, where we cater those opportunities to your email box in an Excel format, allowing you to adjust the analysis to your preferred view. On the NLT Alerts, we report high-probability setups for:

- Stocks and their options

- Futures

- FOREX

We take several cuts and consistently report overall market conditions and individual industry sector developments.

Here is an example of an overview:

NLT Weekly Industry Sector Development of the S&P 500

The S&P 500 index is in an NLT Purple Zone where the word “Change” tells you that you expect a consistent price change rather than a direction in the price development. Ten out of twelve seconds show momentum upwards, and nine out of twelve are in an uptrend.

For the week of March 20, 2023, our indicators and Alerts showed NEM as an independent stock with buying power.

NEM Weekly NLT Top-Line Chart

Hence, with the right tools, you can make educated decisions that help you understand what is possible at any market stage.

Let us pick another example of a more popular stock:

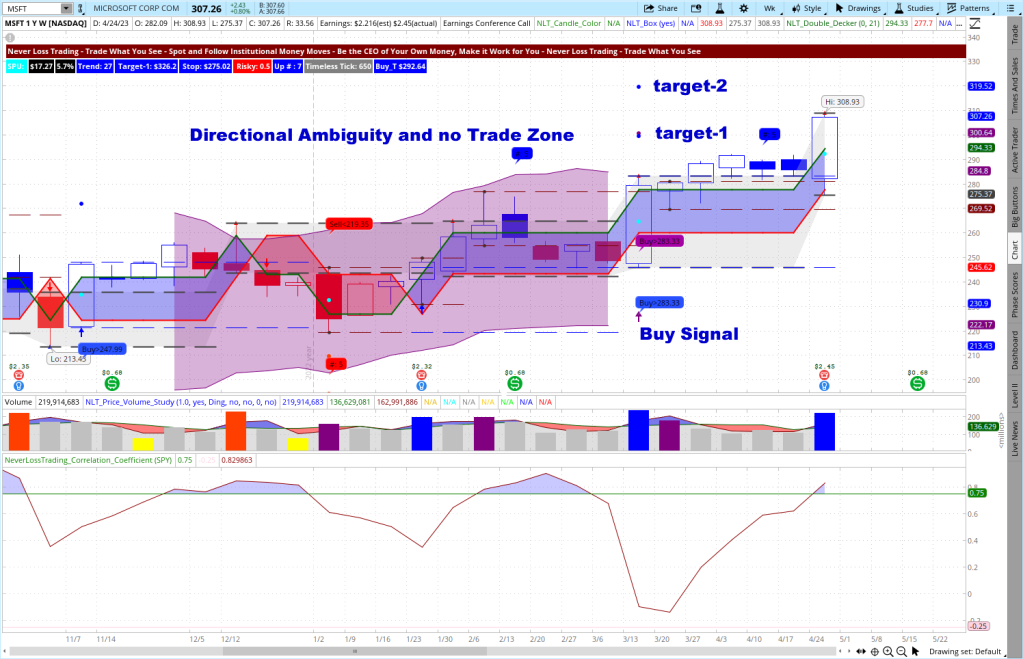

MSFT, Weekly NLT Top-Line Chart

Decide on your own if it was an uncorrelated price move and a strong buy signal (end of purple zone buy and blue NLT PowerTower buy signal at one candle).

Our mentorship teaches you how to participate in such price moves with risk-limiting strategies that fit any account, even an IRA.

We hope we got the point across: it is crucial for you as a trader to make a fact-based market analysis and decisions:

- Highly probable buy or sell decisions

- Appropriate risk-limiting strategies

- Entry, exit and stop specified for every trade

- Choosing a market-depending investment strategy

- Combine longer-term and shorter-term transactions

- Strive for constant improvement

Another alternative for markets that show directional ambiguity, you can scale down to shorter-term strategies, holding invesmtments short-term:

- Swing trading: holding open positions between one and ten days based on daily chart happenings

- Day trading: opening and closing your positions the same day

IBM Daily NLT Top-Line Chart

Check the chart for an independent, even opposite to the overall market price move that concluded on April 24, 2023, at target-2.

The market has 40,000 stocks to trade, and you can always find and follow an independent happening. The NLT Top-Line scanners and Alerts help you to act when it matters.

Suppose you trade from an IRA and want to follow IBM to the downside. In that case, the NLT Delta Force Concept will allow you to do so without shorting the stock: trade with Put options at a system-specified strike price, time to expiration, knowing the maximum price to pay for the options or change to another adequate strategy.

AAPL Daily NLT Top-Line Chart

The chart shows a confirmed price move indication on April 13/14, leading to a trade that reached its target on April 28, 2023, and we do not enter on the exit candle, even though it carries a buys signal. Indeed, there are some rules to learn to drive with our systems, but we are here to teach you in one-on-one meetings at your best available days and hours.

Check the chart for the following:

- Was it an independent price move happening (yes)

- Was the price entry condition of Buy > $ 165.80 met (yes)

- Did the trade come to target: dot on the chart (yes)

- Was the target reached in the means of 10 bars (took 11)

- Did you see conflicting signals (no)

- Are NLT signals 100% certain (no, but > 65%)

If you prefer day trading, we developed a concept that helps traders always find risk-adequate directional solid price moves.

On our NLT Timeless Day trading chart, we use system-defined price increments to specify the start and end of every candle instead of time, helping you multifold:

- Each setup is in the system-appropriate risk/reward ratio, which is often not given in time-based candles

- Your entries and stops are less predictable by not following time-based patterns

- You trade for meaningful minimum price changes of the underlying instead of being eaten up in volatility

- The system produces multiple trading opportunities in the trading day for all assets

In our first example, we pick a FOREX trade: USD/CAD. You will see two trading opportunities that came to target. In addition, the system specifies a maximum price expansion by a black dot, where we expect counter-action.

USD/CAD NLT Timeless and Trend Catching Chart

On the chart: The first directional indication came on April 25, 2023, and the second on April 28, 2023. Dots on the chart specify the exit, and red crossbars the stop. You operate with buy-stop and sell-stop bracket orders.

The E-Mini S&P 500 Futures contract is a prevalent day trading instrument, and we trade it on two frequencies with the NLT Timeless Concept.

NLT Timeless /ES Slow Pace Chart

NLT Timeless /ES Fast Pace Chart

Please decide on your own if you found more winning than losing signals, expecting an accuracy of > 65%.

If you’re ready to take your trading to the next level, consider implementing a structured approach and see the difference it can make.

contact@NeverLossTrading.com Subj.: Free Consultation

NeverLossTrading is a trading education and software company that aims to help traders improve their performance and profitability in the financial markets by:

- Personalized Coaching: in one-on-one sessions, you learn customized trading strategies that fit your unique needs and goals. This personalized approach can help traders better understand the markets and make more informed trading decisions.

- Trading Software: NeverLossTrading offers proprietary software that provides real-time market analysis and trading signals. Our indicators are designed to help traders automate their trading decisions and execute trades with greater accuracy and efficiency.

- Comprehensive Training: We provide extensive training and education materials to help traders learn the fundamentals of trading and develop the skills and knowledge necessary to succeed in the markets.

To succeed in trading, you best work with an experienced coach. Our #1 competitive advantage is the support and customer service we offer. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to make a difference in your trading: We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong. Strive for improved trading results, and we will determine which of our systems suits you best. The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. The markets changed, and it can be an expensive undertaking if you do not change your trading strategies with them. However, you can make a difference with the right skills and tools!

Hence, take trading seriously, build the skills, and acquire the tools needed. Trading success has a structure you can create and follow.

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

Entry filed under: Trading Education. Tags: Algorithmic Trading, Day Trading, FOREX, Futures Trading, Never Loss Trading, Stock Market, Stock Trading, Swing Trading, trading concept, Trading Plan, trading system.

1. 2023 Traders Challenge | NeverLossTrading Blog | May 20, 2023 at 6:07 am

2023 Traders Challenge | NeverLossTrading Blog | May 20, 2023 at 6:07 am

[…] Last week’s article explained how to swing trade with the NeverLossTrading Concept, and we do not want to repeat the same message; if you are interested in holding positions for multiple days, please check for our concepts here. […]